Efile 8849

Form 8849, Schedule 6 is filed when you have sold your vehicle after filing the Form 2290 Return. Also, you would be using the Form 8849 to claim a credit if your vehicle was destroyed, stolen or was used 5,000 miles or less on public highways (for agricultural vehicles, it is 7,500 or less) during a given tax period.

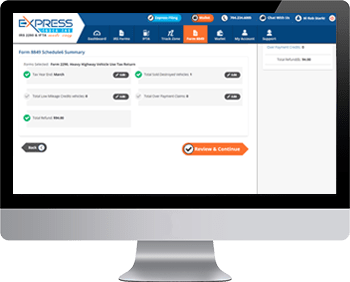

You can e-file Form 8849 with Efile8849online.com to claim a refund or credit, for vehicles that haven’t exceed the mileage limit, stolen or sold or destroyed and heavy vehicles use taxes which have been paid previously. To file 8849 online you need to provide your name and address as per the IRS records.

If your vehicle was stolen or destroyed, you need to provide the date when the event occurred. For example, if the vehicle was destroyed in an accident, you must specify the date and time when it happened and even provide a brief description of the incident.